The Real Cost of Taking That Discount: Understanding Boots Theory

“The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money. Take boots, for example. [...] A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while a poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.”

—Terry Pratchett, Men at Arms

Terry Pratchett was a master of weaving social commentary into his fantastical tales! His character, Captain Samuel Vimes elegantly explains how opting for short-term savings can lead to higher costs over time.

In the novel, Vimes reflects on his own financial situation, earning $38 a month plus allowances. A good pair of leather boots costs $50, which would last for years and keep his feet dry. However, unable to afford this upfront cost, Vimes can only buy cheaper boots for $10, which wear out quickly and often leak after a season or two due to poor materials like cardboard soles. Over a decade, a wealthier person who can afford the $50 boots spends only that amount once, while a poorer person like Vimes would spend $100 or more on multiple pairs of cheap boots and still end up with wet feet.

While the Boots Theory is traditionally framed around how poverty forces individuals into costlier cycles of purchasing low-quality goods, an identical behavioural pattern/ trap emerges among those not in poverty, driven by a psychological attraction to habitual consumption, discounts and short-term savings.

That behavioural pattern is something you can address with awareness.

Choosing the cheaper option upfront often means paying more over the lifetime of a product, whether it’s clothing, electronics, or even a car.

It happens everywhere you look: the slow drips that drain you

- Shoes: A $20 pair might last 6 months, costing $80 over 2 years (4 pairs). A $60 pair lasts 2 years, saving $20 and offering better support.

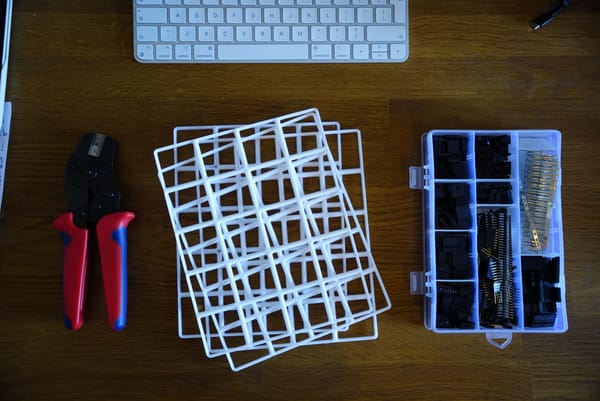

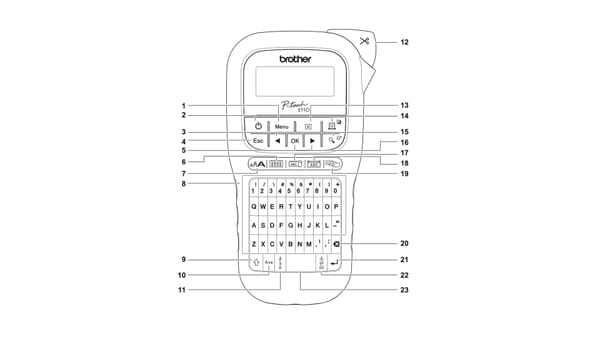

- Printers: A $50 printer may need $30 ink cartridges every 3 months ($120/year), while a $200 printer uses $20 cartridges lasting 6 months ($40/year), saving $80 annually.

- Cars: A $5,000 used car could require $2,000 in yearly repairs, totaling $10,000 over 5 years. A $15,000 car with $1,000 annual maintenance costs $5,000 over 5 years, half as much.

- Appliances: A $300 washing machine lasts 5 years, while a $900 model lasts 15 years. Over 15 years, the cheaper one requires 2 replacements ($900 total), matching the durable one’s cost but with added inconvenience.

A short-term savings mindset can quietly inflate expenses.

Beyond traditional consumption

Boots Theory isn’t exclusive to any income level—it’s a universal trap for anyone who focuses excessively/ exclusively on immediate affordability. This mindset drains resources that could be redirected to savings, investments, or simply less stress. It also has broader implications:

- Healthcare: Skipping a $50 checkup to save money might lead to a $5,000 emergency surgery later.

- Education: Choosing a cheap, subpar path could cap future earnings compared to a quality programme.

And the cost is not just the money...

It's not just about money

God damn it, an entire generation pumping gas, waiting tables; slaves with white collars. Advertising has us chasing cars and clothes, working jobs we hate so we can buy shit we don’t need.

— Tyler Durden, Fight Club

Falling for cheap deals fills your home with junk! Clothes you won’t wear, gadgets you don't use, trinkets you don’t need. All of it, stealing space, spiking stress, and wasting hours sorting the mess. You can do better with less.

On top of the toll on your mental health, your purchase decisions also provide incentives for companies to keep on churning out disposable, low-quality crap for quick profits, sidelining durable goods. It squanders innovation and jobs that could build lasting, valuable products.

But perhaps the worst of all is what this does to the planet and environment. The EPA reports 4.9 pounds of daily trash per American (much from flimsy throwaway, cheap stuff) fuels landfills, pollutes oceans. This of the penguins next time you buy that "just one more" dress you saw on TikTok.

Breaking the Trap: 5 Actionable Steps

To escape the Boots Theory trap, adopt a mindset of long-term value. Here are five practical steps:

- Calculate total cost of ownership: Factor in maintenance, replacements, and usage costs, not just the sticker price.

- Prioritise durability: Choose items with strong warranties or proven longevity, even if they cost more upfront. Join Reddit's BuyItForLife group!

- Buy used or refurbished: Get quality at a discount! Second-hand gems often outlast new budget items.

- Invest in maintenance: Regular upkeep for cars or appliances extends their life and prevents expensive breakdowns.

- Opt for quality over quantity: Buy fewer, better things—a single durable coat beats multiple cheap ones.

- Sometimes (oftentimes), the cheapest + best option is the thing you already have: Think carefully before pulling the trigger - do you really need this? Really?

Hope you found this interesting!

And next time you eye a bargain, consider the total lifetime cost of your purchase.